There were many incidents reported where non registered hotels and restaurantsof duping the bill with GST, CGST and SGST tax rates. Non registered businesses such Hotels and Restaurants should not collect GST tax for products and services as they are not paying Goods and Services Tax to Central and State Governments. There were multiple reports from customers who posted the bills from Hotels and Restaurants in social networks, asking how to verify GST amounts in the food bills. Here is a quick guide to verify the the GST taxes included bills and how to verify that restaurant have registered gst.

1. Check the GST number in Bill

Register dealer should print GST number on their bill. It is mandatory for business entities to print the registered GST number on the bill provided to a customer. GST number will look like this, “

06AACCG0527D1Z8“. It is mandatory to show GST rates on the bill separately.

From 6th letter of GSTIN you come to know whether the person is Individual or any firm or company If 6th letter is “P” then it is individual. If it other letters, it means other form like firm/company/organisation etc.

In case Hotel applied to GST and on pending status, then they should enter ARN number on the bill. Unless the customer can rightfully reject to pay GST rated bill. GST registration is always from the date of application or date mentioned in application. After getting registration certificate, restaurant has to pay GST from back date. In that case the hotel should at least enter the ARN in that case, GST applied under this this ARN No.

2. Verify the GST number

There are chances where Hotels and Restaurants provide fake GST numbers to get money. You can verify GST number in this link:

https://services.gst.gov.in/services/searchtp. Enter the GST number and Captcha. You will details on;

GSTIN/UIN: 06AACCG0527D1Z8

Legal Name of Business: GOOGLE INDIA PRIVATE LIMTED

Centre Jurisdiction: NA

State Jurisdiction: Gurgaon (East) Ward 2

Date of registration: 01/07/2017

Constitution of Business: Private Limited Company

Taxpayer Type: Regular

GSTIN / UIN Status: Active pending Verification

Date of Cancellation

Nature of Business Activities

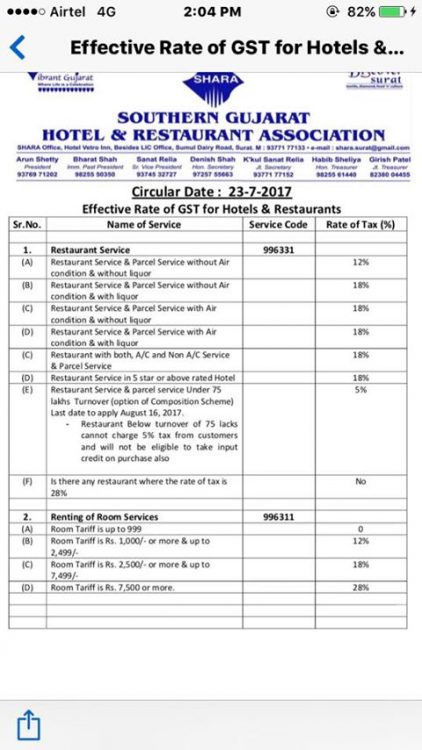

3. Get Awareness on GST rates ofHotels and Restaurants

– For non-AC/non-alcohol serving hotels, it is 12%. This means 6% SGST and 6% CGST.

– For AC/alcohol-serving hotels, it is 18%

MRP means Maximum Retail Price. The GST tax should be included in the MRP.

GST Tax means Goods and Service Tax

SGST means State Goods and Service Tax

IGST means Interstate Goods and Service Tax.

4.In case of GST Fraud, where should we file complaint?

– Phone: 0120-4888999 , 011-23370115

– Twitter: @askGST_Goi , @FinMinIndia

Duped Bills Example

In this bill, GST No: Applied is printed which means that the business is not registered under GST. They changed the price when a customer asked them about it.