GST Applies to the following provinces in Canada

- Alberta

- British Columbia

- Manitoba

- Northwest Territories

- Nunavut

- Québec

- Saskatchewan

- Yukon

Current Province PST Rate in Canada

- British Columbia 7%

- Manitoba 8%

- Québec 9.975%

- Saskatchewan 6%

Harmonized Sales Tax Rates in Canada

Province HST Rate Federal Part Provincial Part

New Brunswick 15% 5% 10%

Newfoundland and Labrador 15% 5% 10%

Nova Scotia 15% 5% 10%

Ontario 13% 5% 8%

Prince Edward Island 15% 5% 10%

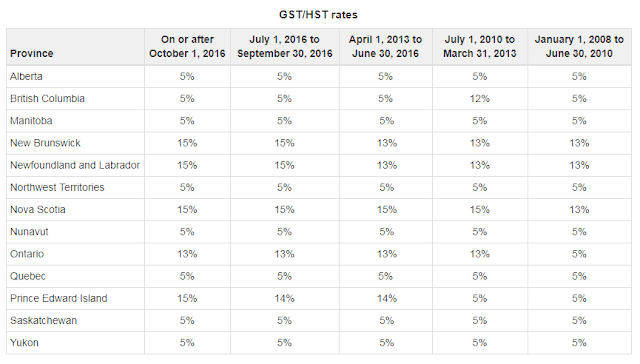

Update On GST/HST rates For All Provinces

For On or after October 1, 2016 July 1, 2016 to September 30, 2016 April 1, 2013 to June 30, 2016 July 1, 2010 to March 31, 2013 January 1, 2008 to June 30, 2010.

GST Calculator Canada

Goods and Services Tax Calculator Canada

Explanation of the GST Calculation Formula

Add GST

GST Amount = ( Original Cost * GST% ) / 100

Net Price = Original Cost + GST Amount

Remove GST

GST Amount = Original Cost – ( Original Cost * ( 100 / ( 100 + GST% ) ) )

Net Price = Original Cost – GST Amount

Example: A product is sold from place A to Place B at the rate of Rs.1000. GST rate is 10 %. What is the net price?

Solution :

= 1000 x (10 / 100)

= Rs.100

Hence the net price is 1000 + 100 = 1100$

Original Cost: 1000 $

GST %: 10

GST Price: 100 $

Net Price: 1100 $

Tax Calculator India under GST With Example

State and Local Sales Tax Calculator United States For 50 states